The MassMutual Federal Credit Union (MMFCU) was chartered in 1962 to provide alternative and affordable financial services options to the employees of the Massachusetts Mutual Life Insurance Company (MassMutual). The employees of MassMutual chose to establish a cooperative, not-for profit financial institution whose board of directors is elected by and from its members. We are proud our mission remains consistent with our founders – To improve the financial well-being of our members by providing valued products and exceptional service.

Since our inception, numerous events and economic circumstances have caused disruption and hardship to our members. No matter the year or the event, change has been a constant and MMFCU has been a constant for our members throughout, no matter the headwinds. 2022 proved to be a particularly challenging year due to continuing repercussions from the COVID-19 pandemic, and the resulting economic challenges led by skyrocketing inflation and an unprecedented rise in interest rates.

Despite the unforeseen challenges in the economy, MMFCU had a positive year with respect to our overall operations. We are proud to report that the credit union remains financially healthy and our purpose to enrich the lives of our members remains our priority. Additionally, our financial results and further investments in capital projects highlight the overall strength of your credit union.

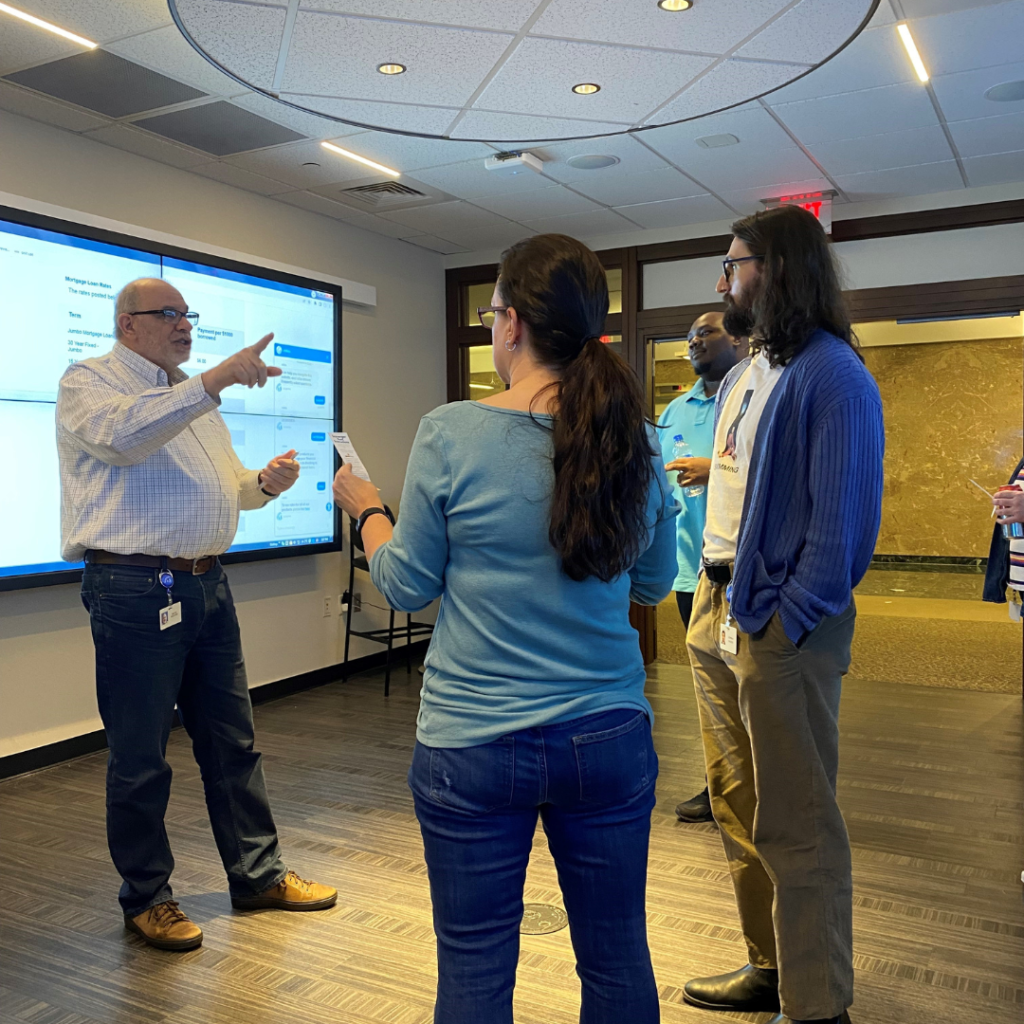

As our members continue to shift their preference of banking to the use of digital channels, we continue our strategic initiatives to build upon our digital platforms to better serve our members by providing a Digital First option for our products and services. We remain committed to the enhancement of our digital platform and its overall experience to ensure we meet our members needs today, and in the future.

A sample of the items we implemented this past year that supports our commitment to enhance our digital experience include:

- Introduction of a chatbot to our website and home banking platforms

- An upgrade to a new and improved lending platform

- An upgrade to a new and improved online account opening platform

Future economic challenges create opportunities for the MMFCU, and we continue to position ourselves accordingly to maximize the benefits and value to our members. Therefore, we continue to look forward prudently, anticipate the future needs of our members, improve upon the many products and services offered, and pursue strategic opportunities when presented. MMFCU is committed to providing the guidance, products, and services necessary to assist our members no matter the challenges ahead.

We would like to express our gratitude to our members for a successful year despite the many economic challenges we all faced. We appreciate your continued trust and support. We look forward to what 2023 brings as we continue assisting you on your financial journey.